Law Articles

2021-04-20

MLM

Should Taiwan's multi-level marketing businesses be subject to deposit and minimum capital requirements — Observations and sharing from a comparative legislative perspective.

【Zhong Yin Law Firm Partner Charlotte Wu and Attorney Li Dechang】

Charlotte.wu@zhongyinlawyer.com.tw

Charlotte.wu@zhongyinlawyer.com.tw

According to Article 38 of our Multi-Level Marketing Management Act, after a multi-level marketing enterprise files with the Fair Trade Commission, it must pay into the Protection Fund as well as annual fees to the Multi-Level Marketing Protection Fund Association, so that the Association can handle civil disputes arising from multi-level marketing between the enterprise and its distributors.

In recent years, as various parties have repeatedly discussed amendments to the current Multi-Level Marketing Management Act, there have been voices proposing converting the protection fund system into a security deposit system, or debating whether a minimum capital requirement is necessary. The establishment of a security deposit system would affect the hundreds of existing multi-level marketing companies in our country and would increase restrictions on new entrants; whether to establish or change such a system must be approached cautiously. Therefore, this article intends to start from two perspectives—the legal status of multi-level marketing management abroad and the legal status of industries in our country that have a security deposit system—in hopes of providing a comparative observation on whether to establish a security deposit system for our multi- level marketing enterprises, with the aim of stimulating further discussion.

1. Legal status of multi-level marketing management abroad

1.1. Singapore, Hong Kong: No filing with or permission from the government required

1.1.1 Singapore:

Singapore initially passed the Multi‐Level Marketing and Pyramid Selling (Prohibition) Act in 1973, prohibiting multi‐level marketing and pyramid selling. However, because not all multi‐level marketing activities were considered intolerable, in 2000 the Singapore Parliament amended the Act to relax controls on multi‐level marketing, finding that insurance businesses, franchising businesses, and direct selling businesses that meet certain standards were not within the Act’s prohibition [1]. After deregulation, the Singapore government did not further require direct selling businesses to register with or obtain permission from the government, so direct selling enterprises currently operate in Singapore without applying for a license, needing only to take care to avoid being regarded as illegal pyramid selling operations.

1.1.2 Hong Kong:

Hong Kong also adopts relatively relaxed regulation for direct selling businesses, having only the Pyramid Schemes Prohibition Ordinance (Cap. 617), which prohibits pyramid selling schemes where the scheme’s funds are wholly or substantially derived from the introduction of other members [2], but does not require direct selling businesses to register with or obtain permission from the government.

1.2. Malaysia: Requires government approval and has certain paid-up capital requirements. Malaysia's regulations on direct selling are mainly contained in the Direct Sales and Anti-Pyramid Scheme Act, which stipulates that entities engaged in direct selling must be companies registered under the Malaysian Companies Act and must apply for government approval under the Direct Sales and Anti-Pyramid Scheme Act [3].

In addition, depending on the company's capital composition and the nature of its direct selling activities, Malaysia imposes different paid-up capital requirements on direct selling businesses [4]. The following is a summary:

1.3. Thailand: Government approval required and certain paid-up capital and collateral requirements.

Thailand initially imposed moderate regulation on direct selling. Its Direct Sales and Direct Marketing Act, promulgated and implemented in 2002, only required anyone engaging in direct sales or direct marketing to apply for registration with government authorities [5]. However, after the Act was amended in 2017, it added provisions that the minimum registered capital for partnerships applying to engage in direct sales (Direct Sales) [6] shall not be less than 500,000 baht, and the company's minimum registered and paid-up capital shall not be less than baht; furthermore, direct selling businesses must submit collateral to guarantee disputes between the business and consumers. Such collateral may be cash, bank letters of credit, government bonds, or state-owned enterprise bonds, etc., as approved by the government Items designated by the gate. [7]

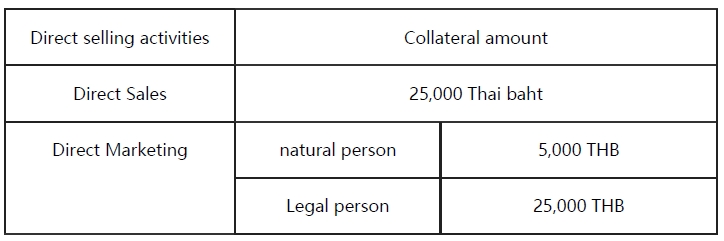

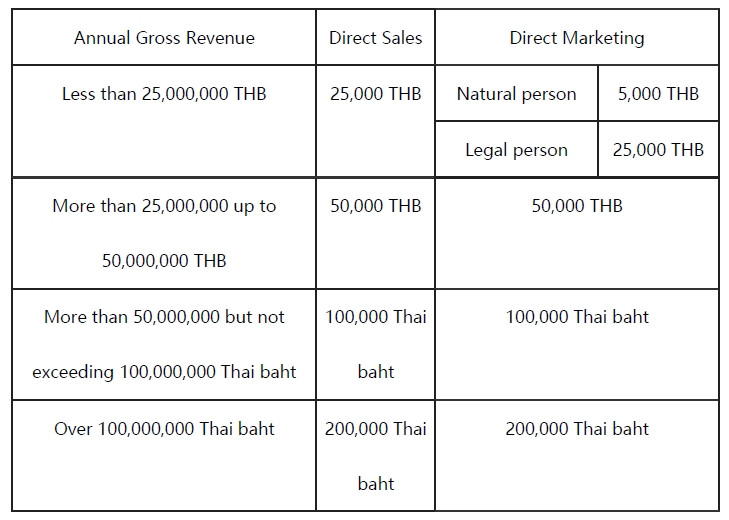

In 2018, the Thai government further issued administrative regulations [8] requiring both existing and newly applied direct selling businesses to submit securities to the Office of the Customer Protection Board (OCPB); the amounts are summarized as follows:

1.3.1 Newly applied direct-selling businesses: Classified according to the direct-selling activities carried out by the business, the business must thereafter report its annual total revenue each year to the Office of the Consumer Protection Board of Thailand to determine whether the guarantee amount should be increased.

1.3.2 Existing direct selling businesses: Based on the direct selling activities carried out by the business and its annual total revenue, the business must thereafter report its annual total revenue each year to the Office of the Consumer Protection in Thailand to determine whether the surety amount should be increased.

1.4. China: requires government approval and has certain paid-in capital and deposit requirements

China's regulation of direct-selling businesses is relatively strict. According to Article 7 of the Administrative Measures for Direct Selling of the People's Republic of China, a company applying to become a direct-selling enterprise must have investors who have not had major illegal business records for five consecutive years prior to application; foreign investors should have more than three years of experience in direct-selling activities outside China; and the company's paid-in registered capital shall not be less than RMB 80 million [9].

In addition, when registering, a direct selling enterprise must open a special account at a bank designated by the government and deposit a performance bond of RMB 20,000,000, and the amount of that bond shall be adjusted monthly, remaining within a range not exceeding RMB 100,000,000 and not less than RMB 20,000,000, and maintained at of the previous month's direct selling product sales revenue of the direct selling enterprise [10].

1.5. Summary

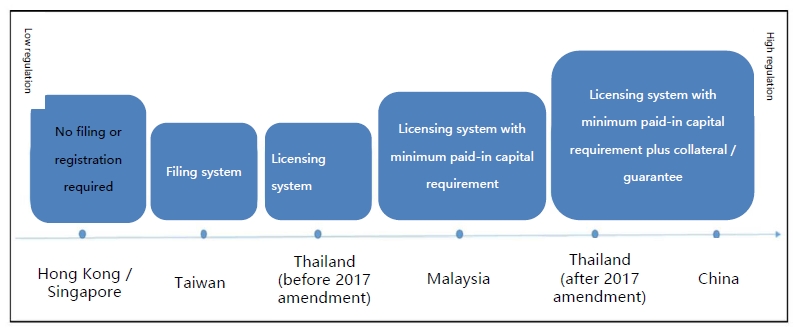

From foreign legislation, it can be seen that the intensity of international regulation of multi-level marketing businesses varies greatly. Hong Kong and Singapore have low regulation; as long as laws are not violated, direct- selling operators do not need to apply for government permits and may engage in direct-selling activities.

Malaysia has medium regulation; direct-selling businesses must obtain government approval and are subject to a minimum paid-in capital requirement. Before the 2017 amendment, Thailand was of low-to-medium regulation, requiring only government approval for direct-selling businesses without requirements for security deposits or minimum paid-in capital; after the 2017 amendment, it moved toward higher regulation, requiring direct-selling businesses to provide collateral and setting minimum paid-in capital limits. China adopts high regulation for direct-selling businesses; compared with Thailand and Malaysia, China’s requirements for paid-in capital and security deposits are higher, and it also requires foreign investors to have more than three years of experience in direct-selling activities outside China.

2. Current Legal Status of Domestic Businesses with a Deposit System

2.1. Travel Industry: Collects deposits according to travel agency category and has the Taiwan Travel Quality Assurance Association to handle disputes with consumers.

Because the customary practice in the travel industry is for consumers to pay the tour fee in full before departure, and after departure the travel agency provides services such as lodging, transportation, and guides, there is a time gap from when the travel agency receives the tour fee until the services are completed. To prevent travel agencies from maliciously going bankrupt and leaving creditors or consumers without recourse, our country has a deposit system for travel agencies [11].

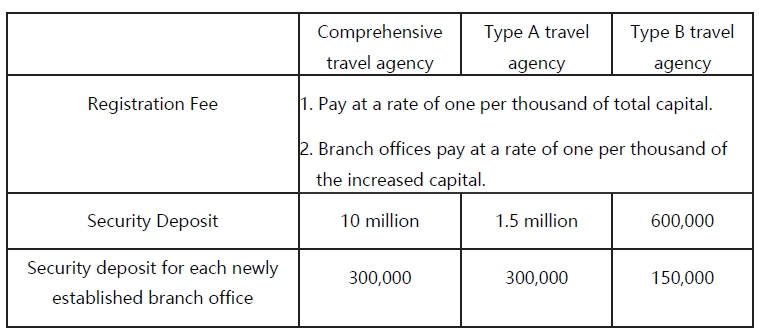

Also, travel agencies in our country operate under a licensing system; when applying for registration and a license, they must pay a registration fee to the Tourism Bureau of the Ministry of Transportation and Communications and

The security deposit, this registration fee, and the standards for the amounts of the security deposit are as follows [12]:

Among these, the relationship between the security deposit and the Taiwan Travel Quality Assurance Association (hereinafter referred to as the "Quality Assurance Association") requires special introduction. In 1989 the Ministry of Transportation and Communications assisted private travel operators in establishing the Quality Assurance Association, which also set up a Tourism Dispute Mediation Committee to handle dispute cases transferred by various agencies and organizations or complaints directly filed by tourism consumers against member travel agencies; additionally, to deal with mediation outcomes, members are required to pay an additional protection fund upon joining. If, after mediation, compensation for damages to consumers arising from a member’s breach of a travel contract is warranted, the Quality Assurance Association may use that fund to make the payment and then recover the amount from the travel agency in order to protect consumers [13]. Therefore, if a travel agency is a member of the Quality Assurance Association, has operated the same type of business for two years without being subject to suspension, and its security deposit has not been forcibly executed, then pursuant to the relevant provisions of Article 12 of the Regulations for the Administration of Travel Agencies, it may apply to the Tourism Bureau of the Ministry of Transportation and Communications for a refund of nine-tenths of the security deposit, meaning it need only pay one-tenth of the aforementioned security deposit.

2.2. Real estate brokerage / sales agency businesses: collection of security deposits according to number of business premises and establishment of the Republic of China Real Estate Brokerage / Sales Agency Business Operation Guarantee Fund to handle transaction disputes.

To regulate the real estate brokerage industry, establish order in real estate transactions, and protect the rights of transacting parties, our country’s Regulations on the Administration of Real Estate Brokerage Businesses stipulate that after completing company registration, brokerage businesses must also pay an operation security deposit into the dedicated account of the Republic of China Real Estate Brokerage / Sales Agency Business Operation Guarantee Fund, which is managed by the Fund Management Committee [14]. If, due to reasons attributable to the brokerage business, it fails to perform the commissioned contract and the principal suffers damage, and the injured party obtains an enforcement title against the brokerage business or its personnel, arbitration is upheld, or the Fund Management Committee issues a resolution, the Fund may indemnify on behalf of the brokerage business up to the amount of the security deposit and provided guarantees, and then notify the brokerage business to make supplementary payment [15].

Furthermore, according to Article 3 of the Measures for the Deposit or Provision of Guarantees for Operation Security Deposits for Real Estate Brokerage Businesses promulgated by the Ministry of the Interior of the Executive Yuan, the standards for collecting the security deposit are:

2.2.1 For brokerage businesses that establish five or fewer business premises, each business premises shall deposit NT$250,000; for more than five business premises, each additional business premises For each additional business location, an additional NT$100,000 shall be paid.

2.2.2 For each business location, if the number of brokers exceeds five, an additional NT$30,000 shall be paid for each additional broker.

The aforementioned amounts shall not exceed NT$10,000,000 in total. In addition, if the calculated total security deposit is NT$5,000,000 or less, it must be deposited in cash or by sight draft; if it exceeds NT$5,000,000, the excess portion may be guaranteed by a letter of guarantee from a financial institution.

2.3. Summary

The travel industry and real estate brokerage industry are both sectors that require government authorization, and both have bond systems to protect consumers. However, the travel industry’s bond is calculated based on industry category plus the number of branch offices; for the brokerage industry, it is calculated based on business premises and whether the number of brokers at that premises exceeds five.

In addition, the agencies that manage the bonds and the collection mechanisms differ. The travel industry uses a two-stage system: the government first collects a higher bond amount at registration, and if a travel agency conducts the same type of business for two years without being subject to a suspension, and joins a quality- assurance association, it can recover nine-tenths of the bond; the real estate brokerage industry, on the other hand, has its funds managed by a special fund account and a fund management committee established by the national federation of professional associations for real estate brokerage/agency and sales.

3. Conclusion: Observations on the establishment of bonds for multi-level marketing businesses in our country Our country currently applies a "notification system" for multi-level marketing businesses. Before beginning

multi-level marketing activities, a business must submit legally required documents to the Fair Trade Commission. This notification system operates on a "consent in principle, prohibition by exception" basis and does not conduct substantive strict review of whether the business’s activities are lawful, so it is not a licensing system. In Taiwan, once a multi-level marketing business has completed the notification, as long as it does not change its products or compensation plan, unlike some foreign regimes (for example, Malaysia’s direct selling license renewal requirement), there is no need for annual notification updates.

Against this background, whether to establish a security deposit actually relates to Taiwan’s policy choices regarding the regulation of direct selling businesses. Referring to "Figure 1: Regulatory Intensity of Direct Selling Businesses in Various Countries" for further thought, if Taiwan adopts a low level of regulation, is it necessary to add a security deposit requirement and thereby increase restrictions on the direct selling industry? If Taiwan adopts a medium level of regulation, rather than requiring businesses to pay a security deposit, converting the legal framework to a licensing system that gives the government the authority and responsibility to screen out bad direct selling operators at the source and educating the public to recognize legally licensed direct selling businesses may better achieve the goals of regulating the industry without unduly suppressing its development. If Taiwan chooses to move toward a more stringent level of regulation, in addition to a licensing system and security deposits, consideration could be given to following other countries’ legislative examples and adding a minimum paid-in capital requirement. The author suggests that discussions should pay attention to different legal provisions and institutional designs and adapt them to local conditions and national circumstances.

Figure 1: Regulatory Intensity of Direct Selling Businesses in Various Countries

In addition, looking at the current legal frameworks for industries in Taiwan that have security deposit systems— such as the travel industry and real estate brokerage/development sales—if policy chooses to establish a security deposit, it is also necessary to consider which agency will manage the deposit and how it will be collected. Should it follow the travel industry’s two-stage approach—collecting a higher initial deposit and allowing part of it to be returned if the business operates for a certain number of years without violations? Or should it mirror the current multi-level marketing protection fund system, calculating the deposit amount based on the direct selling business’s sales in the previous fiscal year and having the fund manage it? These questions remain to be discussed.

In summary, regarding whether Taiwan’s multi-level marketing businesses should be required to post a security deposit or meet a minimum capital requirement, if there is a need for such legislative amendment, it must still be considered by industry, legal professionals, and academia within the context of Taiwan’s overall regulatory policy. If a security deposit is implemented, its amount and operational mechanism also need to be communicated and agreed upon by all parties. The author has compiled the current legal frameworks of various countries in this paper in the hope of sparking interest and prompting further attention and discussion of this issue.

[1] National Association of Travel Agents Quality Assurance Association of R.O.C. What can the Quality Assurance Association do for tourism consumers? URL: http://www.travel.org.tw/info.aspx?item_id=7&class_db_id=51&article_db_id=68 (Date last accessed: March 30, 2020)

[2] Article 7, Paragraph 3 of the Real Estate Brokerage Management Act: "Upon completion of company or business registration, the brokerage enterprise as referred to in the first paragraph shall deposit an operational security bond in accordance with the regulations prescribed by the central competent authority. Where the operational security bond to be deposited by a brokerage enterprise exceeds a certain amount, the excess portion may be secured by a guarantee letter provided by a financial institution."

Article 8 of the Real Estate Brokerage Management Act: "The operational security bond referred to in the third paragraph of the preceding Article shall be uniformly deposited in a dedicated operational security fund account at a designated financial institution by the National Federation of Real Estate Brokerage Associations or Real Estate Sales Agency Associations of the Republic of China, and a management committee shall be formed to be responsible for its custody; the interest from the fund may be used to improve the real estate brokerage system. Among the members of the fund management committee referred to in the preceding paragraph, the number of members serving as brokerage enterprises shall not exceed two-fifths of the total number of members. The organization of the fund management committee and the fund management measures shall be prescribed by the central competent authority. Unless otherwise provided in this Act, the operational security fund referred to in the first paragraph shall not be disbursed unless the circumstances specified in Paragraph 4 of Article 26 apply. When the operational security bond deposited separately by a brokerage enterprise is lower than the amount specified in Paragraph 3 of Article 7, the National Federation of Real Estate Brokerage Associations or Real Estate Sales Agency Associations of the Republic of China shall notify the brokerage enterprise to make up the deficiency within one month."

[3] Article 26, Paragraph 4 of the Real Estate Brokerage Management Act: "After an injured party obtains an instrument of execution against a brokerage enterprise or brokerage personnel, or after an arbitration award is rendered or a resolution for payment is passed by the fund management committee, the injured party may request the National Federation of Real Estate Brokerage Associations or Real Estate Sales Agency Associations of the Republic of China to make compensation on its behalf within the total amount of the operational security bond deposited and the security provided by the brokerage enterprise; upon making compensation on its behalf, it shall immediately notify the brokerage enterprise to make supplementary payment within a specified period in accordance with the provisions of Paragraph 4 of Article 8."

[4] Article 7 of the Regulations on the Administration of Direct Sales of the People's Republic of China: "To apply to become a direct selling enterprise, the following conditions shall be met: (1) investors shall have good commercial reputation and have no record of major illegal business operations for 5 consecutive years prior to the application; foreign investors shall also have more than 3 years of experience in engaging in direct selling activities outside China; (2) the paid-in registered capital shall not be less than RMB 80 million; (3) the security deposit shall be paid in full at a designated bank in accordance with the provisions of these Regulations; (4) a system for reporting and disclosing information shall be established in accordance with regulations."

[5] Article 29 of the Regulations on the Administration of Direct Sales of the People's Republic of China: "Direct selling enterprises shall open special accounts at banks jointly designated by the commerce department of the State Council and the industry and commerce administration department of the State Council to deposit security deposits. The amount of the security deposit shall be RMB 20 million at the time of the establishment of the direct selling enterprise; after the direct selling enterprise commences operation, the security deposit shall be adjusted monthly, and its amount shall be maintained at 15% of the sales revenue of direct selling products of the direct selling enterprise in the previous month, but shall not exceed RMB 100 million at the maximum and shall not be less than RMB 20 million at the minimum. The interest on the security deposit belongs to the direct selling enterprise."

[6] Article 30 of the Tourism Development Act: "Travel enterprises operating in accordance with regulations shall pay a security deposit; the amount thereof shall be determined by the central competent authority. When the amount is adjusted, travel enterprises already approved for establishment shall also apply. Travelers have the right to preferential repayment against the aforementioned security deposit for claims arising from travel disputes against travel enterprises. If a travel enterprise fails to pay the security deposit in full as prescribed and is notified by the competent authority to pay within a specified period, and still fails to pay upon expiration of the period, its travel enterprise license shall be revoked."

[7] See Article 12 of the Regulations Governing Travel Enterprises.

[8] Direct Sales and Direct Marketing Act, B.E.2545 (2002), Section 38. “Any person who wishes to operate the business of direct sales or direct marketing shall apply for registration with the Registrar under the terms and procedures as may be imposed by the Commission.”

[9] Thailand categorizes direct selling activities into Direct Sales and Direct Marketing. Direct Sales refers to marketing activities involving the sale of goods or services through direct sellers at non-permanent business locations; Direct Marketing refers to marketing activities involving the promotion of goods or services through the provision of information or the remote sale of goods to consumers, requiring consumers to express their intention to purchase to the operator. For Direct Marketing, there is currently no minimum paid-up capital requirement.

[10] ACT GOVERNING DIRECT SALES AND DIRECT MARKETING (RELEASE 3) B.E. 2560, available at http://www.tdsa.org/upload/Download/ACT%20Direct%20Sales%20and%20Direct%20Marketing%20_Edited_%20B.E.2560.pdf (last visited: March 30,2020)

[11] Ministerial Regulation: Collateral Requirement for Direct Sales and Direct Marketing Business B.E. 2561 (2018), available at http://www.tdsa.org/upload/Download/5.%20Collateral%20Requirement%20for%20Direct%20Sales%20and%20Direct%20Marketing%20Business%20_B.E.2561%20_2018_.pdf (last visited: March 29,2020)

[12] Minister of Trade and Industry, FAQs on Multi-level Marketing and Pyramid Selling, available at https://www.mti.gov.sg/Legislation/Legislation/Multi-level-Marketing-and-Pyramid-Selling (last visited: March 29,2020)

[13] HK Government Press Release, Pyramid Schemes Prohibition Ordinance comes into effect on January 1, Dated December 23, 2011, available at https://www.info.gov.hk/gia/general/201112/23/P201112230217.htm (last visited: March 29,2020)

[14] Direct Sales and Anti-Pyramid Scheme Act, Section 4.” (1)Subject to sections 14 and 42, no person shall carry on any direct sales business unless it is a company incorporated under the Companies Act 1965 and holds a valid license granted under section6.”

[15] Ministry of Domestic Trade and Consumer Affairs, How to Apply for Direct Sales License, available at https://www.kpdnhep.gov.my/en/trade/business/business/business/business/direct-sales-industry-development/methods.html (last visited: March 29,2020)